Introduction

This brief updates the economic model I released last week detailing COVID-19’s impact on global oil markets. As there continues to be much speculation about actual global demand for oil during this downturn, most public numbers are based on estimates. The models that we have created are based on historical driving levels by country, and the relative amount of people who are covered under shelter in place orders.

Key assumptions in our analysis are:

- A consistent ratio of work/commute driving and non-work/commute driving.

- Virtually all oil demand loss is due to individual passenger vehicles and airlines. As a result, the portion of global demand is being modeled almost entirely on the portion of oil that is being refined into gasoline and diesel for individual vehicles, and jet fuel.

This update does not cover the foundational methodology of the model. That information was provided last week in a webinar that can be viewed here.

Additional data added to the model since last week includes:

- Production cuts from areas such as the United States, Canada and Brazil as producers have voluntarily reduced rates due to low prices and warnings from buyers to reduce production.

- Reduced storage volumes and rates at which regional storage is filling.

- Changes to economic impacts based largely on unemployment updates, such as the US increase of 6.6 million last week.

- News of China beginning to lighten restrictions in certain areas as COVID-19 in that country is beginning to wane.

Production

Based on reports from operators, regulators, and midstream companies, it appears that supplies have dropped slightly from recent highs. We estimate global production to have dropped 1.5 million barrels per day in the last week.

Demand (current)

Since last week, there have been slight additions to the number of people covered under stay at home or shelter in place orders. However, reports are that people are increasing compliance with these orders. Finally, unemployment levels are increasing dramatically in certain areas. To balance that, it appears that demand is beginning to increase in China, as stay at home orders are being lifted, although this is very early data. All together, we estimate that demand has dropped just below 78 million barrels per day (mbpd).

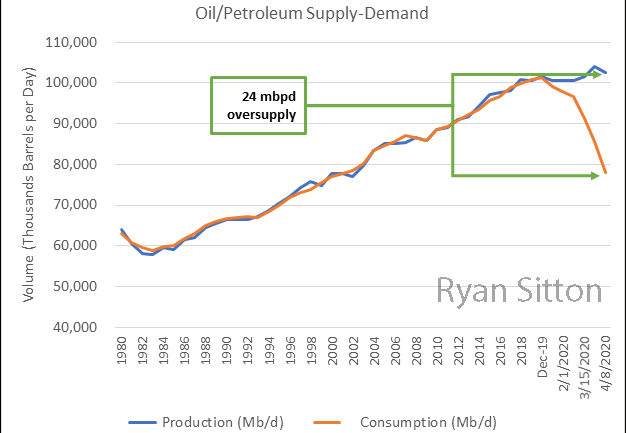

Figure 1 shows the updated global supply/demand curves, and the current oversupply of 24mbpd, relative to historic levels (this is an increase from 17.9mbpd in last week’s analysis).

Figure 1 – Oil Supply and Demand as impacted by COVID-19

Short-Term Issues

We estimate that at current US oversupply levels (4 to 5 million barrels per day), US storage will fill up in roughly two months, with the first area (mid-continent) to be at full capacity in mid-May.

Once storage is full, US oil production will have to match real time consumption levels. Given that US refiners require a heavy/sweet mix of approximately 2 to 1, this means that US refiners will be running approximately 10 mbpd of light sweet crude (WTI). Between contracts to bring some of this crude in from overseas, and high inventories to be drawn down. We anticipate that US oil production will drop to 8 to 9mbpd after oil storage is full.

Demand Projections

Demand levels are driven down both due to people working from home, and massive unemployment. Our assumption is that demand will go up almost immediately for those who are working when the Shelter-In-Place lifts. However, the demand will return slowly as people who lost their jobs take time to return to the job market. Therefore, the longer that people shelter in place, the more layoffs occur, the longer it will take for demand to return.

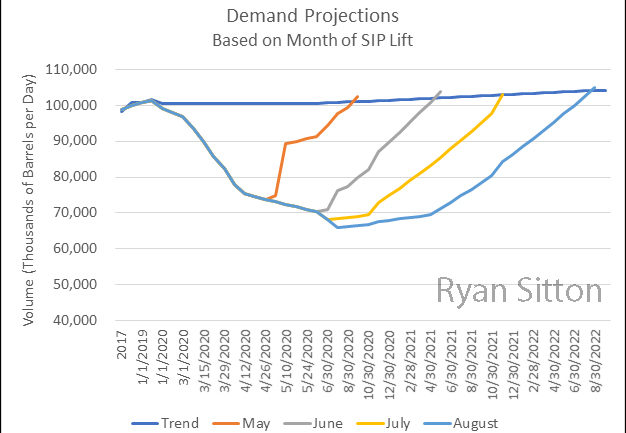

Figure 2 shows our updated demand projections based on when the majority of orders to Shelter in Place are lifted in areas of high oil consumption such as China and the United States.

Figure 2 Projections for recovery once shelter-in-place is lifted

The important conclusions include:

- If SIP orders are lifted in May, then demand should return to normal levels in September, 2020

- If SIP orders are lifted in June, then demand should return to normal levels in June, 2021

- If SIP orders are lifted in July, then demand should return to normal levels in November, 2021

- If SIP orders are lifted in August, then demand should return to normal levels in August, 2022

Watch my previous supply & demand webinar here.?