Inspiring Energy Industry's Future Leaders

Ryan Sitton Inspires Energy Industry’s Future Leaders in Series of Speaking Events

Pinnacle founder shares industry experience in hopes of inspiring next generation

November 19 (HOUSTON) – Ryan Sitton, founder of Pinnacle, the world’s largest reliability data analytics company and author of debut book, “Crucial Decisions,” was recently featured as a guest lecturer to university students enrolled in top energy management programs across the country. Featured topics included his vast knowledge of data analytics and the energy industry including potential challenges, opportunities and transitions. Sitton, the youngest person honored as a distinguished engineering alumnus by Texas A&M University, will continue to educate students through a series of speaking events into February 2021 on how data is redefining the energy industry and why the secret to sustainability is reliability.

In late October, Sitton was invited to virtually speak with students enrolled in the University of Tulsa’s energy department to share his vast experience with business analytics and data systems, explaining how big data helps industry leaders make complex decisions, a topic widely discussed in his newly released book, “Crucial Decisions.”

Most recently, Sitton spoke to students at Rice University during the university’s annual energy finance summit, moderated by Rachel Adams-Heard of Bloomberg, to share how energy supply and demand may change both domestically and globally in the coming years. Sitton also shared the changes ahead in the energy industry and what navigating those opportunities, challenges and transitions may look like for those involved.

Sitton and the Pinnacle team are ardent about investing time and resources into early stage innovative companies in the reliability technology space. In October, Pinnacle announced the establishment of Pinnacle Ventures, a corporate venturing fund, and a commitment to invest $50 million into startups with impactful data-driven solutions.

“Innovation is at the core of Pinnacle’s values,” said Sitton. “While we continue to drive innovation internally, we also want to empower others within the energy industry to do the same in order to make the energy industry the most reliable it has ever been. Students are our future and we want to inspire and support them in as many ways as we can, whether that be sharing our knowledge and expertise through these series of talks or by supporting early stage innovation companies, we are committed to continuously supporting and improving the energy industry.”

On Nov. 30, Sitton will sit down with students at Texas A&M University for a virtual distinguished lecture in energy. On Feb. 2, 2021, Sitton will speak to students at the University of Texas as a guest of the university’s energy symposium series.

For more information on Ryan Sitton, please visit: https://ryansitton.com.

About Ryan Sitton:

Ryan Sitton is the founder of one of the world’s largest reliability data analytics companies. He consults international corporations on energy markets, holds a number of patents in system design, and has served as chief energy regulator for the state of Texas. He has spent the last decade developing and applying quantitative methods to ensure optimal reliability.

About Pinnacle:

Headquartered in Pasadena, Texas, Pinnacle is exclusively focused on helping industrial facilities in the oil and gas, chemical, mining, and water and wastewater industries better leverage their data to improve reliability performance, resulting in increased production, optimized reliability and maintenance spend, and improvement in process safety and environmental impact. Pinnacle is privately held, and has been consistently recognized for its growth by Inc Magazine, the Houston Business Journal, and more. For more information, visit pinnaclereliability.com.

Politics Wins, Texans Lose

In 1911, the US government broke up Standard Oil, because they recognized that one company controlling 90% of the market was not a free market.? Eight years later, the Texas Legislature recognized the potential for oil being produced in excess of market demand, they realized how harmful that could be to the industry and economy, and they outlawed it.? Texas law defines that as ?waste? and it charges the Railroad Commission of Texas (RRC) with preventing that waste.? Those laws are still on the books today.? They knew the ?free market? works, but they also recognized that government must take steps to protect that market from extraordinary circumstances.

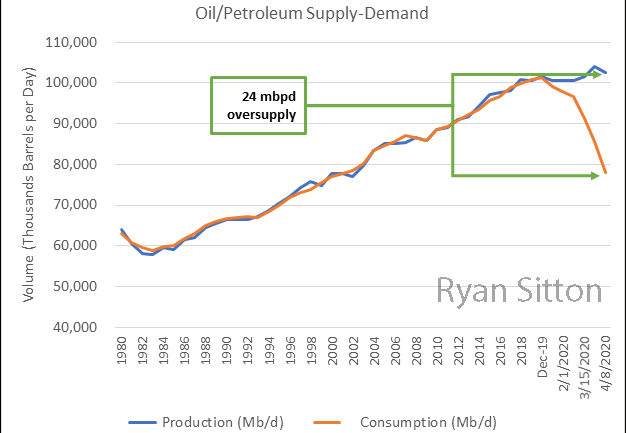

In the wake of the largest oil market disruption in human history, there have been strong opinions regarding how best to respond.? AS the world went from producing and consuming around 100 million barrels per day (mbpd) to still producing 100mbpd but only consuming 70mbpd, it sent shockwaves through the markets the likes of which have never been seen (e.g. oil trading at a negative value).

Oil storage facilities are filling up everywhere.? Tankers full of oil are being parked off the coasts.? The RRC has received requests from multiple midstream companies to store oil in pipelines. Soon, there may be nowhere for US produced crudes to go.

In response to the demand destruction and the global oversupply, operators asked the RRC to restrain production to prolong the filling of storage. The hope was that demand would return before the entire Texas energy industry was wiped out from unprecedented low pricing and lack of infrastructure. ?As one of three statewide elected officials charged with leading the RRC, I believed it was important to take the request seriously and to determine the magnitude of waste occurring and what, if anything, the RRC might do to prevent it.

My mission has been to exercise the duties delegated under state law and ensure that the energy industry survives to keep Texas and the US energy strong.? I believed that Texas acting alone couldn?t do that which is why I have only advocated for Texas reductions if other states and nations participated.? No one acting alone can solve a 30mbpd global oversupply.? OPEC+ can?t do it alone, the G-20 can?t do it alone, the ?free market? can?t do it alone.? But if someone had led an international effort six weeks ago to slow down production, storage could have remained available and mass shut-ins in oil fields across Texas could have been avoided.? Now, it?s too late.

Has there been waste that the RRC is charged with preventing?? Absolutely.? One could start with the differential between Brent and WTI, net to producer.? That number has ranged between $5 and $15 in the past few weeks.? If we use an average of $10 per barrel, at 5 million barrels per day, there will have been $1.3 billion in waste over a 30-day span.? When you add in the ?non-COVID-19? value of that crude oil (say $50 per barrel), and the long-term destruction of oil production in the US, the jobs, and the future purchase of more barrels from overseas, the waste could easily exceed $100 billion. We should have analyzed that.

Instead, the discussion at the RRC devolved into a philosophical ?free market? discussion versus a fact-based, data-driven discussion.? I worked to focus on the data, follow the law, and quantify the reality of hundreds of thousands of Texas energy workers losing their jobs and businesses. Political groups, representing oil interests from all over the world worked to keep the debate from even happening.

The same ?free market? politicians arguing against proration want the federal government to turn Saudi oil tankers around.? And they want special loans for the oil industry.? And certain oil companies want the government to provide storage and waive rules and help keeping leases, and to stop paying royalties?..and on and on and on.? These are all requests for the government to intervene in the ?free market.? If everyone were intellectually honest they would admit government needs to act to save domestic energy production; the only question is which government and how should they act to best accomplish that goal.

Everyone says that businesses respond faster than government.? People are pointing to the wells around the country that are already being shut-in and saying, ?See, we didn?t need you to tell us to restrict production.? It?s true that this distorted market is working, and oil is shutting down.? In Mid-May or early June when storage is full and some companies are forced to shut in all of their wells while larger ones continue to operate, it will be a sad time in Texas history.

Most economists are now projecting that after our economy begins to run again, there will be an initial jump up in oil demand, before the market settles between 90 and 95mbpd of demand, 5 to 10mbpd less than pre COVID-19.? Supply will match that demand, and the world will cut production. But where will the supply reduction come from?? It looks like most of those losses will come from the United States.? Between the rapid decline of shale wells, the massive number of bankruptcies and layoffs, and lack of government support, our energy industry will struggle to compete with overseas national oil companies who are larger and have the backing of their governments.

Are we okay with the US oil industry being decimated while the rest of the world survives?? When oil prices go back up to $80 per barrel in three or four years, but much more of that money is going overseas, will we accept that it was just ?the free market?? If not, the question is, ?Why didn?t we do something??? Because we didn?t do the work, we won?t have an answer.

In short, I am not disappointed that we did not prorate.? I am disappointed that we didn?t do our job.

Global Oil/Petroleum Market Snapshot

Introduction

This brief updates the economic model I released last week detailing COVID-19’s impact on global oil markets. As there continues to be much speculation about actual global demand for oil during this downturn, most public numbers are based on estimates. The models that we have created are based on historical driving levels by country, and the relative amount of people who are covered under shelter in place orders.

Key assumptions in our analysis are:

- A consistent ratio of work/commute driving and non-work/commute driving.

- Virtually all oil demand loss is due to individual passenger vehicles and airlines. As a result, the portion of global demand is being modeled almost entirely on the portion of oil that is being refined into gasoline and diesel for individual vehicles, and jet fuel.

This update does not cover the foundational methodology of the model. That information was provided last week in a webinar that can be viewed here.

Additional data added to the model since last week includes:

- Production cuts from areas such as the United States, Canada and Brazil as producers have voluntarily reduced rates due to low prices and warnings from buyers to reduce production.

- Reduced storage volumes and rates at which regional storage is filling.

- Changes to economic impacts based largely on unemployment updates, such as the US increase of 6.6 million last week.

- News of China beginning to lighten restrictions in certain areas as COVID-19 in that country is beginning to wane.

Production

Based on reports from operators, regulators, and midstream companies, it appears that supplies have dropped slightly from recent highs. We estimate global production to have dropped 1.5 million barrels per day in the last week.

Demand (current)

Since last week, there have been slight additions to the number of people covered under stay at home or shelter in place orders. However, reports are that people are increasing compliance with these orders. Finally, unemployment levels are increasing dramatically in certain areas. To balance that, it appears that demand is beginning to increase in China, as stay at home orders are being lifted, although this is very early data. All together, we estimate that demand has dropped just below 78 million barrels per day (mbpd).

Figure 1 shows the updated global supply/demand curves, and the current oversupply of 24mbpd, relative to historic levels (this is an increase from 17.9mbpd in last week’s analysis).

Figure 1 – Oil Supply and Demand as impacted by COVID-19

Short-Term Issues

We estimate that at current US oversupply levels (4 to 5 million barrels per day), US storage will fill up in roughly two months, with the first area (mid-continent) to be at full capacity in mid-May.

Once storage is full, US oil production will have to match real time consumption levels. Given that US refiners require a heavy/sweet mix of approximately 2 to 1, this means that US refiners will be running approximately 10 mbpd of light sweet crude (WTI). Between contracts to bring some of this crude in from overseas, and high inventories to be drawn down. We anticipate that US oil production will drop to 8 to 9mbpd after oil storage is full.

Demand Projections

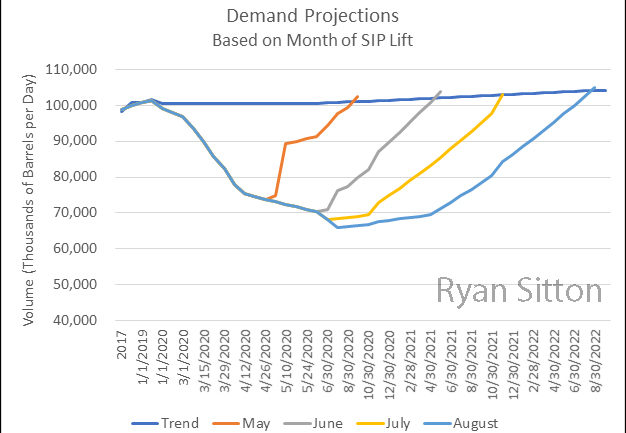

Demand levels are driven down both due to people working from home, and massive unemployment. Our assumption is that demand will go up almost immediately for those who are working when the Shelter-In-Place lifts. However, the demand will return slowly as people who lost their jobs take time to return to the job market. Therefore, the longer that people shelter in place, the more layoffs occur, the longer it will take for demand to return.

Figure 2 shows our updated demand projections based on when the majority of orders to Shelter in Place are lifted in areas of high oil consumption such as China and the United States.

Figure 2 Projections for recovery once shelter-in-place is lifted

The important conclusions include:

- If SIP orders are lifted in May, then demand should return to normal levels in September, 2020

- If SIP orders are lifted in June, then demand should return to normal levels in June, 2021

- If SIP orders are lifted in July, then demand should return to normal levels in November, 2021

- If SIP orders are lifted in August, then demand should return to normal levels in August, 2022

Watch my previous supply & demand webinar here.?

Bloomberg TV Interviews Ryan About the Impact COVID-19 and the Price War Have on Global Oil Prices

The global oil market is dealing with unprecedented and unpredictable turmoil. The coronavirus pandemic is destroying fuel demand across the board. The ongoing Saudi-Russian oil price war has flooded the market, bringing the price of a barrel of oil to a historic low. On Thursday, April 2, 2020 Ryan was interviewed by Bloomberg TV’s Annamarie Horden about the state of the market.

Watch the interview here:

Can the US Protect the Oil and Gas Free Market?

Uncertain times are upon us. Our jobs and way of life are being affected by the coronavirus pandemic and by the measures being taken to halt its spread. While these measures are necessary to suppress the spread, they are also suppressing demand for goods and services, and crippling key parts of our economy. Many families will soon feel a great deal of economic pain, if they aren’t already.

I’m not arguing against steps that have been taken, simply pointing out the reality of the situation.

One silver lining is that gasoline prices have plummeted to near record lows (adjusted for inflation). Low gas prices are usually great for jobs and the economy. I always advocate for energy that is both reliable and affordable. But this apparent positive carries dangers in the current circumstances. It feels great to fill up for less and less each day, but the companies that produce our energy cannot sustain these prices. Normally I would say that this is simply the reality.? The market will work itself out and the survivors will be those who can match their cost and supply to the price and demand.

But make no mistake, these prices are not market driven. For the first time in history, supply and demand have been simultaneously warped by forces completely outside of normal economic markets. On the demand side, fears of coronavirus have decimated our transportation demand.? Obviously, this is not a long-term market shift, simply a short-term response.? Estimates range from a 5 to 10 million barrel a day drop in demand around the globe, just due to this slowdown.? On the supply side, Saudi Arabia is using its spare capacity to challenge Russia for market share and force compliance with cuts. In doing so, they have stated that they will place an additional 3 million barrels per day of oil on the market, artificially cutting prices.? Between previous oversupply, drop in demand, and excess production on the market, it appears that the global oil market could be oversupplied by 10 to 15 million barrels per day, or roughly 10 to 15%.? On an annual basis, this is the highest level of oversupply in history:

YEAR OVERSUPPLY

| 1974 | 5.7% |

| 1971 | 4.7% |

| 2018 | 4.0% |

| 1973 | 4.0% |

| 2016 | 4.0% |

| 2015 | 3.5% |

| 1976 | 3.3% |

| 2014 | 3.2% |

| 2012 | 3.0% |

| 1972 | 3.0% |

Over the course of 1971 through ’73, the global oversupply drove oil prices down to an inflation adjusted $20 per barrel. By 1974, the Middle East oil embargo disrupted the flow, caused domestic (WTI) prices to spike, and global oversupply went to the highest level on record in 1974. The last ten years have seen the next wave of oversupply, as the world’s demand for energy from oil and gas has projected a continuous climb. However, never have we seen oversupply levels where they are today. As a result, there is a surplus of oil that could be hitting the market in the coming months as high as 1 to 1.5 billion barrels. This will far exceed available storage in the world, which may drive oil prices to the lowest price, adjusted for inflation, in history and force producers to shut in production and cut off necessary cash flow to remain in operation.

Due to the shale revolution, United States became the world’s largest oil producer and net exporter, producing in excess of 13 million barrels of oil per day. At current forecasts, this level of production may drop to 5 to 6 million barrels of oil per day over the next few years. This threatens American energy independence and could return our country to the days where wars in the Middle East wreaked havoc on our economy.

Texas is the world’s third largest oil producer. The oil price war endangers our state’s economy and, with it, the national economy. Tens of thousands of Texans are being laid off in West Texas in the Permian Basin and the Eagle Ford of South Texas as companies are shutting down their drilling rigs. The United States and Texas stand at a disadvantage in one respect. Both the Saudi and Russian governments control their oil production, while the United States operates a free and open market.

I know how that sounds. I am a free market capitalist. Free markets have made the United States the strongest and most prosperous nation in history. In contrast, state-run economies never work. Venezuela was once one of the most prosperous economies in the western hemisphere, but under statist socialism, it has become a humanitarian and economic disaster. Free markets work.

All of that said, we are at risk. In the short run, we are at risk that a key part of our economy?our energy sector?goes through a dramatic downturn. In the long run, there are even higher risks that the energy supply will be disrupted when demand returns. If US oil production drops by 3 to 4 million barrels per day as a result of artificially low prices, then in a year or two, when demand comes back and the Saudis and Russians are playing nice, things may look very different. We could see $100 per barrel oil, and $4.00 per gallon gasoline, with a large chunk of that money going overseas. ? That will cause substantial economic pain to everyone in America.

The good news is, we know demand will come back. Demand for oil and gas has grown every single year for the last century. The challenge is weathering this temporary storm.

What can we do?

First, for those of us in the oil and gas industry, this is an opportunity to evolve. How can we find opportunities to cut costs and improve productivity?? When the demand comes back, how can we be ready to move fast to fill it even though we may be slowing down in the short term?? How can we use data to reduce risk and predict system performance so that our overall risk profile goes down?? Slowdowns create the opportunity for us to develop new tools and solutions to capitalize on future opportunities. That is how we have always been successful.

Second, this is an opportunity for Texas and the United States to lead in a way we haven’t in a generation. No one, not the Saudis, Russians, Americans, or anyone else, benefits from unstable energy supplies. Ask any economist. Economies thrive when energy is predictable and affordable. The world needs Saudi Arabia and Russia to stop flooding the market. Now is the time for our leadership to broker the discussion to stave off an extended oil war. And, unbeknownst to most, we have something specific to bring to the table.

The Texas Railroad Commission, which regulates oil and gas production in the state, has the authority to set proration schedules, thereby limiting production for Texas producers. It has not been used since 1973, when OPEC was formed and began controlling swing production. In theory, Texas could cut production by 10%, and if Saudi Arabia is willing to cut 10% from its pre-COVID-19 levels, and Russia is willing to do the same, it would put the market back to the level it was (somewhat oversupplied) before the current crises. While Texas controls its destiny, we don’t control others. We would need our federal government, and our president, to make the deal that stabilizes oil markets. President Trump did write the book on deal-making.

To be clear, I abhor government intrusion into the free market. But, with other governments already manipulating oil markets it’s fair to ask, “Why shouldn’t our government step in to try and reinstate a more market-based approach?”

In an ideal world, this wouldn’t send prices up even to the prices seen three weeks ago. Instead, it would stabilize oil prices in the mid-30s or so. It would still mean hard times for oil companies and low gasoline prices for consumers, but stave off a total oil industry meltdown.

We don’t have the whole picture yet, but with a global pandemic disrupting our lives, perhaps it is worth discussing whether proration for Texas producers is appropriate if it can return the world back to the market. I would love to hear what leaders from industry, environmental groups, and consumers think about our options.

We are facing some of the most uncertain times in decades, perhaps generations. We will face them together. Perhaps it is time for the world leader in energy markets to once again be the United States, and Texas.

Ryan Sitton was elected to the Texas Railroad Commission, which regulates oil and gas production, in 2014. He built his thriving reliability company, Pinnacle, formerly PinnacleART, in his garage in 2006. Today it ensures engineering safety around the world. He is Texas A&M’s youngest ever Distinguished Graduate of its College of Engineering and is the first engineer to serve on the RRC in over 50 years.

Thank You!

Dear Friends, Supporters and Fellow Texans--

Last night, as I watched the primary results come in, I was shocked. I have to admit, I didn?t see it coming, and I am very disappointed. I have truly enjoyed serving you as your Texas Railroad Commissioner, and I was excited about the future. But this is how our election process works, and now someone else will be stepping in to represent the people of this state. While our process is not perfect, it is the finest system on earth, and I was blessed to have been a part of it for these six years. Using your expertise to serve those who are concerned or have a need is one of the most rewarding experiences one can have.

On an individual note, I am truly a blessed man. As many of you know, before I ran for office, I started an engineering and technology company focused on reliability and data analysis for big industries like wastewater treatment, chemicals, and oil and gas. The company has taken off, and even after I stepped away a few years ago to become railroad commissioner, it continued to expand. Last year, the CEO stepped down and left a leadership vacuum. After last night, I was able to let my former colleagues know that by the end of this year, I?LL BE BACK!!!

Many people have asked what happened in the election. Unfortunately, some extremely malicious and false information was fabricated and circulated right before early voting started two weeks ago. I thought that I could ignore it since it was so outrageous, and I was focusing heavily on the general election in November. But in a low-profile down ballot race like Railroad Commissioner, I should have been more focused, and responded with an aggressive campaign of my own. I got complacent, and lost. A good example of the Lord keeping me humble.

Back to public service. There are so many tremendous opportunities for us to move things forward, in everything from energy regulation to healthcare to education. And today, there is so much data available, that I am hoping to use my expertise in data analysis to develop new solutions. However, one thing I have learned is that while I am in politics, my ideas are often discounted or attacked just because I held public office. I am excited to see what I can do now that I will be a private citizen again soon. As one friend put it, ?Holy cow, Sitton? now you are unshackled."

Be on the lookout for a couple of books that I have written. The first one is about leadership and purpose, the second one is about data analytics and human/machine performance. As fate would have it, I now have a bit more time to get them finished!

I cannot thank my friends, supporters and all Texans enough for allowing me to serve over the past five years. I have loved traveling around our state and talking with each of you about energy, leadership, and the values that make Texas exceptional. Your words, your questions, and your connection are what I'll miss the most.

SIncerely,

Ryan

Why Unlocking More Oil and Gas is Good for Every American - And the Environment

…The likelihood that Iran or any other bad actor can use violence or weaponize oil to hurt the global economy has dramatically receded. Why?

American energy leadership is why. As the chief regulator of oil and gas production in Texas, I am on the front lines of American energy production. And I am seeing a revolution that helps all Americans.

Our modern economy needs energy. From the smart phone in your hand to the lights in your home to the electric cars more Americans drive, we depend on affordable and reliable energy. We have vast proven oil reserves, we have the technology to extract it, and under the Trump administration we have the freedom to produce it and get it to market. Americans produce oil and gas more affordably and reliably than anyone else.

This affects everything for the better, including the environment. When I was building my business, I visited about half the world’s refineries. No one produces energy more cleanly than Americans do…

Read the rest at RealClearEnergy.

What are you pursuing: status or purpose?

One of the trickiest issues we face as leaders concerns pursuing status versus living with purpose. I was honored to address the Pasadena Chamber of Commerce on this subject.

The 2019 Energy Market Outlook

Each year I author the Energy Market Outlook, an in-depth analysis of current global energy markets and predictions for the remainder of the year and into 2020. This report examines crude oil, natural gas, and key environmental trends related to energy markets, such as emissions and flaring information. It is based on both historical data from various resources, including the International Energy Agency and U.S. Energy Information Administration, as well as extrapolated data from my own analysis.

Click here to get your free digital copy of my 2019 Energy Market Outlook.

Republican Policies Keep Texas Strong

Republicans believe in the potential of every single young Texan. We also believe that our policies – smaller government and lower taxes, fair and predictable regulation leading to affordable and reliable energy – are what keeps Texas strong. I was honored to speak with the Yellow Rose Republican Women’s Club in Tomball about the coming elections and what Republicans stand for.